The energy transition is bringing new challenges to National Oil Companies (NOCs). The demands of the industry transformations in their own countries are encouraging many NOCs to pursue international ventures. As is the need to innovate, to continuously increase value creation for citizens while modernizing their operations. However, to increase their chances of success in a highly competitive global industry, NOCs will need to clearly define their internationalization strategies and prepare their organizations for these new growth pathways.

Nearly half (45 percent) of the global top 20 hydrocarbonproducing national oil companies have expanded their operations outside of their home countries through processes of internationalization, transforming them into “international NOCs”

Different drivers have triggered NOCs’ internationalization processes:

- In net oil-importing countries, such as China, internationalization has been motivated by the need to secure resources to supply the rising national demand for energy.

- In net oil-exporting countries, internationalization goals are more diverse. These might involve securing markets, accessing highly attractive hydrocarbon resources or strengthening core competencies. Moreover, several NOCs have faced increasing competition in their domestic markets and further pressure to deliver economic returns and value. This has driven them to expand internationally to sustain long-term growth.

Even though most NOCs do not possess substantial international operations, the upcoming energy transition could encourage them to pursue international markets. Further pressures to reduce the cost of production, in order to develop reservoirs that are more complex and implement new digital technologies, will require NOCs to strengthen their asset portfolios and alliances through different strategies. These strategies include internationalization.

Many doors open when NOCs decide to “go international”. It allows them to access markets with attractive prospectivity, diversify their portfolios, strengthen competencies and develop international partnerships. In some cases, NOCs have leveraged advantages of being “state owned” to create alliances with peers to share technology, know-how, and acreage exchanges.

However, returns for large foreign investments in unknown markets are highly uncertain, and compromising large amounts of a state’s financial resources could generate political conflicts. The learning curve associated with an international expansion could be costly for the company. If not handled properly, it could also create significant risk in the process.

NOCs interested in expanding their operations internationally need to be prepared to compete with international oil companies (IOCs) that have been negotiating and managing asset portfolios for decades.

Key success factors for internationalization

In order to compete in international markets, NOCs need to regularly face obstacles such as budget constraints, bureaucratic processes, and inflexibility in adapting to new working and regulatory environments. Arthur D. Little has analyzed several cases and identified key success factors to support these companies’ expansions:

- Compelling value proposition

The main goal pursued through internationalization could include market capture, energy security, strengthening of capabilities, technological improvement, and development of strategic partnerships. However, the purpose of each NOC is different, and a company’s individual purpose must be clear to align stakeholders and define the strategy.

A solid value proposition must also establish the “size of the bet” for the company, according to its risk profile, strategic alignment, and time frame for expected returns.

- Clear and focused strategy

To maximize the probability of success, it is crucial to formulate a clear and focused internationalization strategy by assessing:

- Market opportunities: Prospectivity, exploratory maturity, surface risks, market development, regulations, contractual competitiveness of terms for E&P, and entry barriers.

- NOC competitive advantages: Financial and technical resources, know-how, capabilities, technologies, and cultural or geopolitical affinity.

When selecting international opportunities, there are numerous trade-offs to bear in mind. For example, frontier exploration may require lower entry cost, but present greater geological risks; opportunities under appraisal could generate revenues rapidly but be more expensive; and unconventional exploitations may have shorter payback than deepwater but have higher surface risks.

- Unequivocal shareholder commitment

From the beginning of internationalization, it is crucial to ensure shareholders’ commitment and raise awareness of the risks that arise with international investments in order to obtain longterm returns. The investment commitment, however, must be bound to a cap to manage risk according to corporate policies. Such a cap will guarantee that international ventures do not become “bottomless pits” of investments, and thus allow for new international operations until new revenue streams are developed.

A national oil company’s main shareholder is the nation represented by the government. Therefore, it might also be necessary for companies to design mechanisms to shield investment decisions from short-term political interests and sustain long-term strategic deployment.

- Robust international business development capabilities

During an internationalization process, one of the first steps is to “internationalize” the NOC’s human resources (HR). This means HR has to become multidisciplinary. Most NOCs tend to only hire nationals for managerial positions. However, going abroad requires hiring international human resources to leverage their experience and networks in the target countries. This will strengthen connections with key local players and facilitate the NOC’s access to attractive opportunities.

The successful internationalization of Petronas

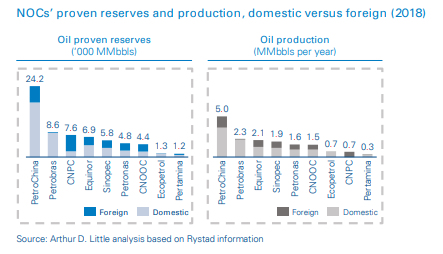

Petronas is the Malaysian NOC and the custodian of the country’s oil and natural gas resources. In 2018, it had more than 3.3 Bboe in proven reserves (approximately 50 percent foreign) and daily production of more than 2.3 Mboe (approximately 40 percent foreign).

Despite being a national oil company, Petronas’ management is rather independent in its decision-making, having strongly pursued international opportunities since the 1990s.

The purpose of Petronas’ internationalization was mainly oriented towards sustaining hydrocarbon reserves and production growth, as well as ensuring access to new markets. It has managed to achieve upstream presence in more than 15 countries, including Canada, Mexico, Iraq, Turkmenistan, the UK, Suriname, Argentina, Egypt, and South Sudan.

Petronas’ key success factors for internationalization were:

- Clarity of vision and purpose: From the beginning, Petronas went abroad with the objective of creating value in terms of growth and profit, while maintaining high operational standards in every geography.

- Leadership and corporate governance: The executive leadership of Petronas has autonomous decisionmaking, separate from government entities.

- Holistic capabilities: Petronas significantly invests in building technical and soft capabilities by promoting employee rotation between national and international positions.

- Cultural identity: Despite Petronas being an internationalized NOC, Malaysian heritage is one of the company’s main values and brings cohesiveness to the entire organization.

- Being the partner of choice: The company promotes international alliances and strong partnerships to share risks, resources, and knowledge in international operations.

A team for new international business needs to be independent of national operations. It must integrate three core competencies:

- Technical: Geoscientists with international experience

- Financial/commercial: Professionals who can identify the potential value creation of opportunities and assess their economic, financial and commercial feasibility.

- Legal: Experts in international law, regulations, contracts, and litigations.

The size and reporting line of the teams in charge of assessing international opportunities depend on the targeted assets and level of maturity (exploration, appraisal, producing, etc.), but they are usually formed within the exploration or production departments. However, as the company’s internationalization process expands and gains maturity, international venture teams must become independent in order to focus exclusively on screening international opportunities.

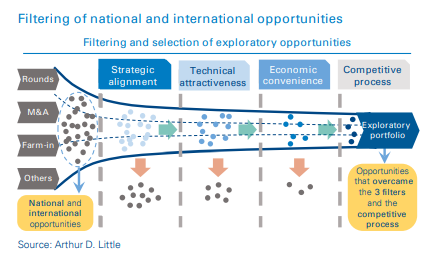

- Rigorous screening and portfolio management

Every opportunity provided by rounds, farm-ins, and potential M&As must pass through a process of screening and filtering to become part of the company’s portfolio. That process must be the same, whether the opportunity is national or international, in order for them to compete equally as potential businesses. It needs to, at a minimum, address the following filters:

- Desired portfolio fit: Type and volume of resources, geological complexity, level of maturity, etc.

- Strategic alignment: Competitive advantages, time to achieve production, projects with scalable investment, and synergies with the NOC’s current capabilities.

- Economic attractiveness: Return over investments, contractual model risks, taxes, fiscal terms, access cost to other opportunities.

- Accessibility and feasibility: Level of competition, social and environmental risks, cultural fit.

- Agile decision-making

The filtering process of international opportunities needs to be structured within a corporate framework in order to guarantee an adequate peer review and escalate decisions properly. Such a framework could take the form of several variants, but we highly recommend that it includes:

- Appropriate stages of revision and control.

- Agility in decision-making.

- Different levels of approval by scale or materiality.

Most international companies adopt processes starting with new-ventures teams. These are responsible for preparing business cases supported by expert reviewers within their companies. The final decision for investment is usually made by a member at the vice presidency level or an executive committee; in exceptional cases the board of directors decides, depending on the scale and strategic impact of the project on the company.

Ecopetrol’s international expansion

Ecopetrol is the Colombian NOC and the main player in its local oil & gas industry. In 2018, it reported more than 900 Mboe in proven reserves (approximately 15 percent foreign) and daily production of more than 0.7 Kboe (less than 10 percent foreign).

Ecopetrol initiated its internationalization process in 2001, after a national energy reform opened the door to pursuing international ventures. The company had an asset portfolio focused on onshore heavy oil in mature basins in Colombia, and wanted to diversify, pursuing international opportunities in oil-prone offshore basins. Initially the company acquired assets in Peru, US-GOM, Brazil, and Angola, but later it decided to focus only on Brazil, US-GOM, and Mexico.

The internationalization strategy has not yet delivered the expected results. However, the company has continued to learn and adjust its strategies to improve its international operations through:

- Increasing the focus of its international portfolio: Exploration investments in the last five years have been focused on selected geographies, such as Brazil, USGOM, and Mexico. Ecopetrol looks for opportunities in high prospective basins where it can leverage its own capabilities or work with qualified partners to create value.

- Internationalizing the executive leadership of the company: In recent years, the company has been hiring executives from different nationalities to build up strong international experience.

- Building stronger alliances and partnerships: Ecopetrol has been able to develop strong alliances with companies such as Petrobras, Anadarko, BP, Petronas and Repsol in Colombia, Brazil, US-GOM and Mexico.

- Leveraging cultural and geopolitical advantages

Several NOCs with international operations began their internationalization among neighboring countries with cultural affinity and regional synergies. This was the case for the Malaysian NOC, Petronas, which started its expansions in Myanmar, Thailand, Vietnam, Indonesia, and Brunei.

Another practice has been to develop an initial portfolio of investments, creating alliances with other NOCs. For example, when Chinese NOCs entered Latin America, they sought to partner with local NOCs on deals that would satisfy both states’ interests.

- Organizational effectiveness

Several areas of the company must get involved if it is to effectively support the internationalization process:

- Exploration: Exploration teams need to be prepared to operate in not only new geologies, but also new regulatory and social contexts.

- Development & production: International opportunities will eventually be handed over to development and production.

- Business development: They will have to integrate, assess, and propose opportunities with drivers and goals significantly different from those of local investments.

- Legal/accounting/compliance: Focus on supporting new international contracts, foreign laws and regulations.

- Supply chain/procurement: Coordination of relations with suppliers, service companies and contractors for international activities.

- Human resources: Coordinate new hiring processes, secondees, rotations, trainings, etc.

Creation of an international independent subsidiary could be beneficial for a NOC in the process of foreign expansion. A subsidiary under a private law will focus on properly executing the international growth strategy without the restrictions of local processes and regulatory framework.

Nevertheless, an international branch would have to be initially financed by the company’s headquarters. If it did not have associated production, certain tax shields could be lost for exploratory expenditures and investments.

Insight for the executive

- The evolution of the energy sector is motivating national oil companies to look beyond their nations’ borders to capture new energy resources, ensure further access to markets, or strengthen their sets of competencies.

- Many NOCs from large oil-producing countries are in the process of assessing international opportunities or consolidating their investment portfolios abroad; they will require rigorous, effective and controlled internationalization processes to ensure alignment with their objectives and mitigate the risks of potential value destruction.

- Proper visualization of an internationalization strategy entails:

- A clear definition of purpose and value.

- Appropriate mechanisms for governance.

- Agile decision-making processes.

- A rigorous approach for assessment of both national and international opportunities.

- Shareholders’ commitment to investments beyond national borders

- Arthur D. Little has proven methodologies to support national oil companies’ internationalizations through processes of strategy visualization, assessment of opportunities, and organization set-up in the context of state ownership.